Post-COVID ‘BTC’ and ‘ETH’ volatility trends to consider

While the COVID-19 pandemic has caused millions of people to lose their jobs and businesses to fail, cryptocurrency has soared in value. Bitcoin, in particular, has soared in weight in the early days of the coronavirus wave, with investors enjoying incredible increases in the leading cryptocurrency’s worth. Following the turn of 2021, Bitcoin reached $34,000 in value for the first time. The cryptocurrency rise in BTC value was caused by large-scale investors seeking to make short-term profits on investments in cryptocurrency.

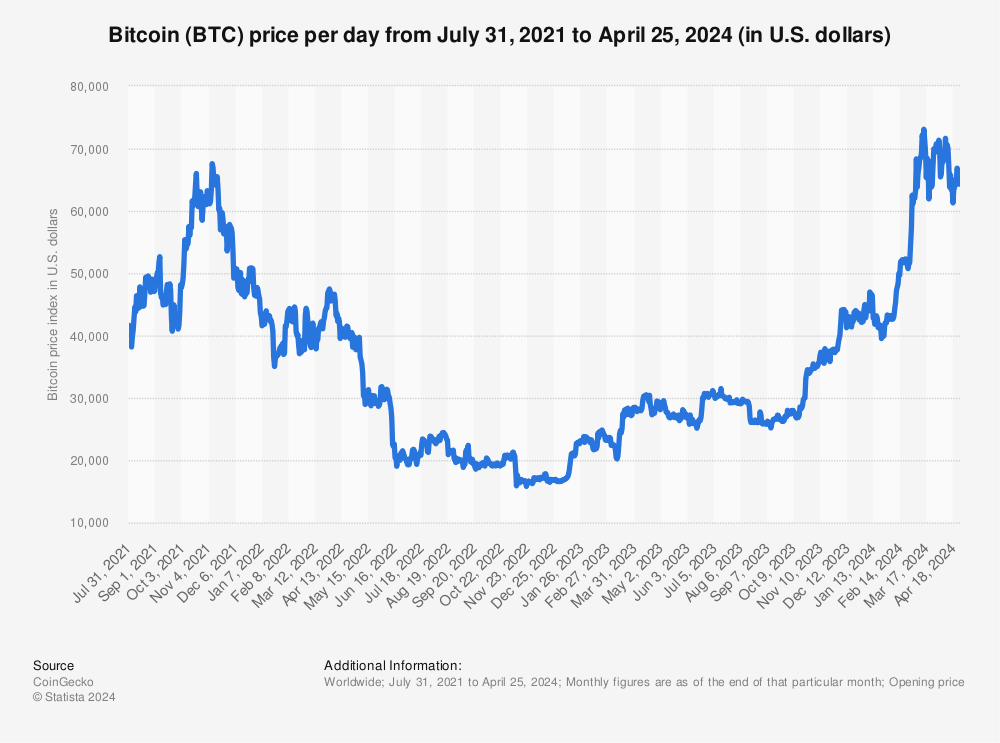

The cryptocurrency’s rise in value

Find more statistics at Statista

In 2020, Bitcoin increased by 300% in value, while other cryptocurrencies also rose around the globe. Galaxy Digital CEO Mike Novogratz claimed the COVID-19 pandemic led to two trends, sending cryptocurrencies to levels never seen. Cryptocurrencies’ rise, however, turned into a fall that started sharply decreasing in value in the last 6 months.

Bitcoin and Ethereum continue to be two of the most popular cryptocurrencies. Both have soared in 2021. The world’s second-biggest cryptocurrency in terms of popularity and trade – ETH – increased 465% in 2020, sending investors wild with the number of profits received.

Company Plot11 created a 90-minutes long documentary about the cryptocurrency rise in prices for BTC & altcoin during the COVID-19 times. They mention fascinating stats, and you may look at the pricing change in crypto from a different perspective. One that could point you to how volatile the nature of cryptocurrencies is.

Why has cryptocurrency increased in value?

According to Novogratz, one reason for the increase in cryptocurrency values was caused by the policies created in response to the COVID-19 pandemic. The United States government’s reaction to the pandemic caused many investors to turn to cryptocurrency as the value of the US dollar weakened. The US Federal Reserve cut interest rates under President Donald Trump and loaned more than $1.5 trillion to financial institutions and banks to keep them afloat. The US government also purchased US Treasury securities to stabilize the economy.

The US currency’s value increased in March 2020, just as the coronavirus outbreak began. Financial investors sought security during the uncertainty of the infection. However, the US dollar’s value dropped following the spring due to the significant stimulus moves by the US Federal Reserve. As a result, the US currency ended in 2020 with its most considerable annual loss since 2017.

The various moves by the US government increased interest in Bitcoin, but Washington DC’s decisions to loan money and cut interest rates are not the only reasons for the cryptocurrency’s rise. Just as important as the US government’s moves were the increase in digital life around the globe. More people are now online, and companies have focused on increasing digital products. For example, companies worldwide have now realized that business meetings and daily work can be accomplished via Zoom. This revelation, which was something digital nomads already knew, has changed how business is conducted.

Will the rise in cryptocurrency continue?

Expanding digital knowledge and life using digital products leads more investors into cryptocurrencies. In addition, the more individuals of all ages use the Internet and become comfortable with technology, the more likely they are to use a digital wallet and buy BTC or altcoins.

Investors trade cryptocurrencies like Bitcoin and Ethereum in similar ways to fiat currencies. With more online marketplaces allowing cryptocurrencies to be used as payments, interest and investment continue to grow. However, while cryptocurrencies rose during the COVID-19 pandemic, it has not changed their volatility.

The rise in cryptocurrency during the COVID-19 pandemic has been put down for several reasons. One of the most recognized reasons, according to cryptocurrency insiders, is the United States government’s moves to cut interest rates and funnel money to financial institutions. Although a critical reason for the increased value of BTC and ETH, it is not the only reason for increased value during the COVID-19 pandemic.

One of the first crypto billionaires, Tyler Winklevoss, shared his prediction on crypto that prices are going to hit new highs.

Skepticism around cryptocurrency is decreasing

According to some investors, cryptocurrency’s boom during the COVID-19 pandemic is gradually wearing out. For example, Inigo Fraser-Jenkins, Bernstein Research’s co-head of portfolio strategy, has been a long-time skeptic of cryptocurrencies. However, the investment guru has altered his thinking after the global changes in December 2020.

Fraser-Jenkins is now informing clients of cryptocurrency’s possible strengths. For example, clients have been told that the COVID-19 pandemic has changed investment diversification options, debt levels, and the policy environment. All of which make Bitcoin and Ethereum more attractive investments. In addition, potential inflation has investors looking more into cryptocurrency than ever before.

Will cryptocurrency’s value bubble burst?

As in the past, many financial insiders are waiting for cryptocurrency’s current value bubble to burst. From the standing point of mid-2022, we can safely confirm the glass really came out to be half full/half empty. Bitcoin’s price collapsed from the madly $60K for 1 BTC to half that number. However, there is a belief, that it may never happen to ever see the prices under $10K again. Nevertheless, the pandemic’s uncertainty over markets and finances gives cryptocurrency enthusiasts hope that more people will invest.

Cryptocurrency is notoriously volatile, and sustaining its current valuation is difficult. A speculative boom caused the cryptocurrency to hit record highs before crashing by 80% three years ago. The number of cryptocurrencies on the market continues to grow.

Of course, not all cryptocurrencies have the pull of the leading coins. Yet, there is still saturation as anyone who can mine coins offers the chance for individuals to buy in.

Most investors think that crypto is not a bubble and won’t crash, just like other industries. However, one of the most prominent investors, Warren Buffett, thinks differently. He believes that crypto is still a bubble – you can listen to his opinion in this video, although many influential investors won’t agree.

Why is cryptocurrency here to stay?

The COVID-19 pandemic has accelerated certain aspects of life, including the way people use money. People are purchasing goods and services online more than ever. In addition, people are now using more contactless ways to pay to prevent the spread of germs. Various online stores and payment options are now giving Bitcoin users the chance to use it for payments – more online groups are expected to follow.

The growth of technology around cryptocurrency and blockchain has improved confidence in investing. Finally, more banking institutions such as JP Morgan now see Bitcoin, Ethereum, and others as significant investment options. In addition, the regular person sees the value in cryptocurrencies, and banking institutions could inform clients to seek investments in decentralized money in the future.

Cryptocurrency should continue to rise thanks to the COVID-19 pandemic’s effects. The only issue may be that the pandemic’s end could see many people go back to the way life was before the coronavirus. For now, it looks like crypto could continue to see increases. The current popularity of cryptocurrency may not have occurred without the pandemic. Now, it is on the verge of becoming more mainstream.